Boosting Client Conversion by Incentivizing Scenario Comparison

ORGANIZATION Northwestern Mutual Planning Solutions

MY ROLE Product Designer

TIMELINE June 2023 -March 2024

Northwestern Mutual (NM) is a life insurance company that works with financial advisors to sell their insurance products to clients. To that end, NM offers a number of tools in their software ecosystem for financial planners and advisors, as well as for their clients to plan, discuss, execute on, and track their recommended financial paths. My team does design work for the Planning Solutions tool (PS), where planners can enter their clients’ facts and financial goals, create a recommended course of action, and present these recommendations.

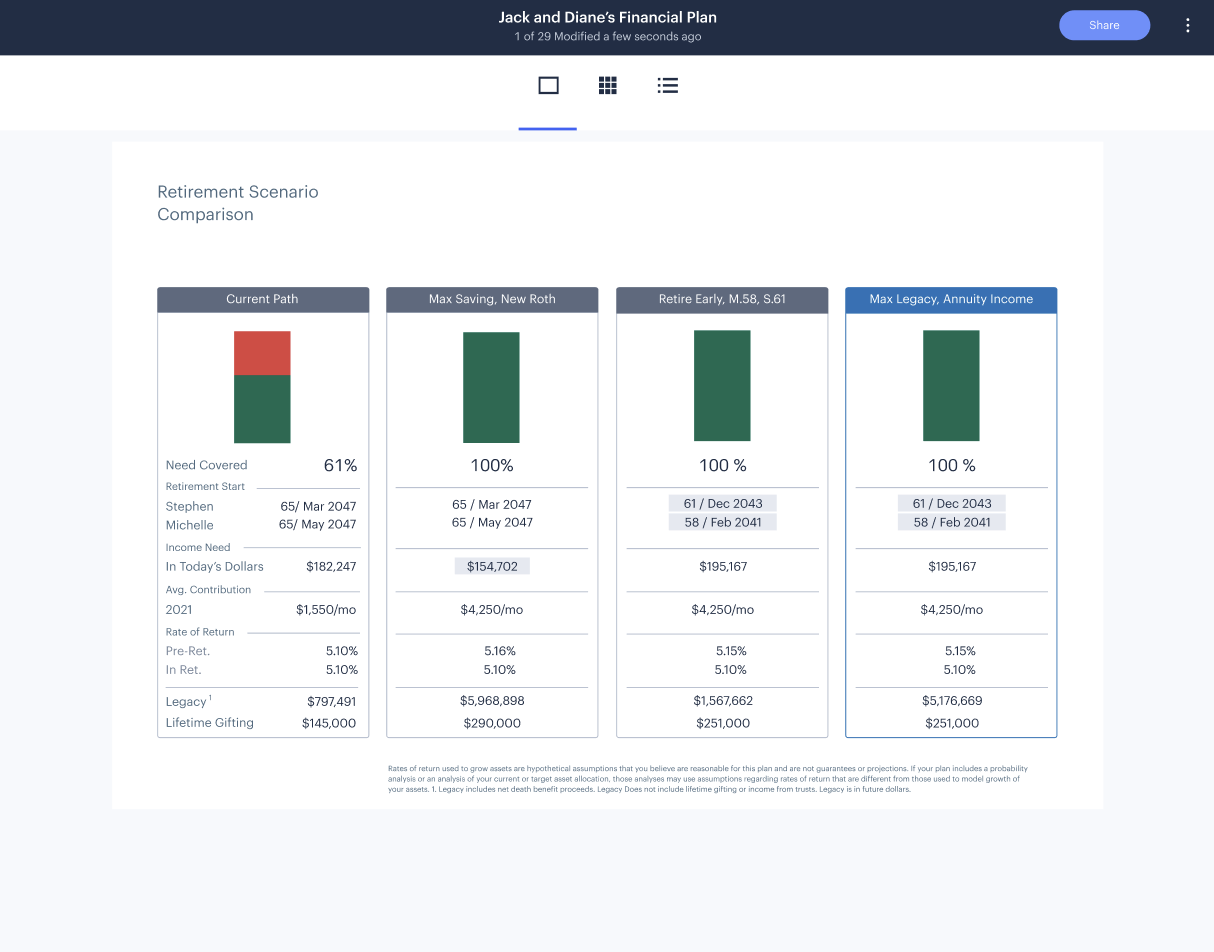

This case study focuses on the last step of the PS journey, creating a plan presentation. One page in the presentation, the Retirement Scenario Comparison (RSC) page, is instrumental in securing clients and selling life insurance policies. I designed new functionality that allowed users to customize this page for their clients.

Business Case

The planning tool allows users to create up to four potential financial paths for their clients to compare. These paths are called scenarios, and extensive user research has shown that when planners use multiple scenarios, they are:

More likely to turn prospective clients into clients

More likely to sell them a life insurance policy

Better positioned to sell multiple policies per client

The Retirement Scenario Comparison page requires that more than one scenario is present. Allowing users to customize this page resulted in more complex plans and a higher sales rate for each plan that used the RSC page.

Users

Financial Planners

Planners are the behind-the-scenes players, preparing and finalizing plans and client materials under the guidance of advisors. They usually engage in:

Entering client data into the planning tool

Configuring the resulting RSC page

Troubleshooting issues in the software

Financial Advisors

Advisors are the client-facing players who gather facts from and present recommendations to prospects and existing clients. They usually engage in:

Analyzing financial projections (such as net worth, insurance value, return on investments, etc.)

Leading client meetings and explaining financial concepts

Problem Space

While the RSC page was touted as a useful resource for financial planners and advisors, our team saw a few opportunities to boost its usage.

Data Customization: Allowing users to add, remove, and reorder data on the page

More Visualizations: Representing data differently to break up the number and text-heavy page

Better use of space: Resizing the display of some data to accommodate as much information as an advisor wants

Scalability: Over time, the amount of available data could grow based on requests directly from our users

Monitoring Success

One month after releasing the RSC customization feature, I worked with our research team to understand how the page was performing with the new functionality. Through user interviews and analytics gathering, we discovered:

Usage of the RSC page went up by 18%

A new Plan Presentation system usability score of 76.7, up from 73.4

Users were satisfied about the new functionality, with 94% of participants stating that it was easy to use

A list of new data points that users wished they could add to this page, which will be present in the next iteration of this feature

Prototype

This prototype, created in Figma, included:

A local component library for different data types to ensure consistency

Detailed specifications on spacing, sizing, and system behavior

A breakdown of all data that can be included on this page, intended to be updated as the feature scales

Reflection

In addition to the new functionality, this feature also acted as a proof of concept for more customization abilities throughout the application. I designed the feature not only to be usable, but to gather useful data. These improvements didn’t just provide a useful affordance to our users; it also ushered in discussions about the future of customizability in our financial planning tool. Insights from this project have informed the next generation of this application, and will provide guidance as our team makes greater strides in usability and desirability.